Client coverage and relationship management in a post-COVID world

There is an old adage that if you put a frog in boiling water, it will jump out, but if you boil the water with the frog in it, the frog will eventually be cooked alive. While I can’t speak to the veracity of frog biology and boiling points, I do connect with one thing: gradual change is hard to appreciate, but rapid change is obvious.

Financial services (markets and investment banking) has felt like it’s the frog in the boiling water for a long time. We all know the industry is going through structural change with material headwinds, but the changes have been slow and incremental, which has led to some responses, but nothing material or significant, especially on the client facing side. Sure, trading has gone through its own renaissance over the last 20+ years, but other parts of the business have only changed incrementally. The change I’m talking about is the natural erosion of margins that come with increased transparency, technology, and efficiency.

The two major revenue sources of both markets and banking are trading and transaction fees, respectively. There might be some disagreement over how much they have changed over the last ten years, but I think everyone will agree that they are compressing. Trading commissions went from quarters, to pennies, to fractions of a penny. While lagging behind for sure, investment banking fees are under the same pressure. I can’t predict the rate of change with much accuracy or certainty, but I can definitely predict the direction: down.

But I’m not here to wax poetically over the compressing revenue of the industry. I’m here to talk about how the industry might be actually having its moment where the frog fortuitously realizes the water is starting to boil.

As I said, while margins were slowly compressing over the last 20 years, there wasn’t a full acknowledgement of the problem, nor a fundamental revisit to how the industry operates – at best, there were surface level changes: compression on comp, ‘juniorization’ of talent, and hiring in lower cost areas (including outsourcing). It wasn’t about changing the model, it was just about decreasing the cost of the model. That is a linear, incremental change.

Then COVID happened.

The industry was shaken up in ways that participants never thought possible. No one thought people could work remotely. No one had a webcam. Most firms didn’t even have video conferencing software!

Now, on the other side of COVID, I’m starting to see management teams at our clients take a step back, and ask themselves if they need a more structural change than just incremental cost management in how they engage with and cover clients across markets and banking. As the founder of Street Context, I’ve been working with our clients for over ten years now. We have thousands of users in sales, investment banking, trading, and research roles, and we’re seeing this evolution first hand globally.

What do I think that evolution looks like? A shift from majority high touch and personalized relationship management to a programmatically supported, scalable, quantifiable, and responsive sales function across all markets and banking that leverages an intelligent combination of programmatic touch, low touch, and high touch.

Let me break that down a bit.

- Programmatically supported: the start of this change is providing scale to the sales/banking organization through the provision of intelligent content creation and distribution, targeted based on internal (low and high touch) and external data points (i.e. 13F, holdings, etc.).

- Scalable: how do you go from covering 20 accounts, to covering 50, 100, or 200 accounts? The simple answer is by having to do less high touch work per account, and having a higher success rate on the remaining high touch activities. As we think about what the next iteration of relationship management looks like, it needs to be much more scalable. Put simply, this means that more information needs to be captured programmatically, and less captured through in-person interactions.

- Quantifiable: the industry has always struggled to understand who internally had impact with clients, and which resources were driving value. In a nebulous relationship management world, that is true, but as the role becomes more quantified, and more onus is put on salespeople to drive interactions and sell products (vs. managing relationships), it will become easier for management to understand impact, and allocate resources accordingly.

- Responsive: as consumers, we have been spoiled in our personal lives with highly responsive product experiences, and customized services. We expect the same in our professional lives. As the technology enabled relationship manager grows, they will use signals from all touch points (previous programmatic, low, and high touch) to drive timely (responsive) high touch interactions

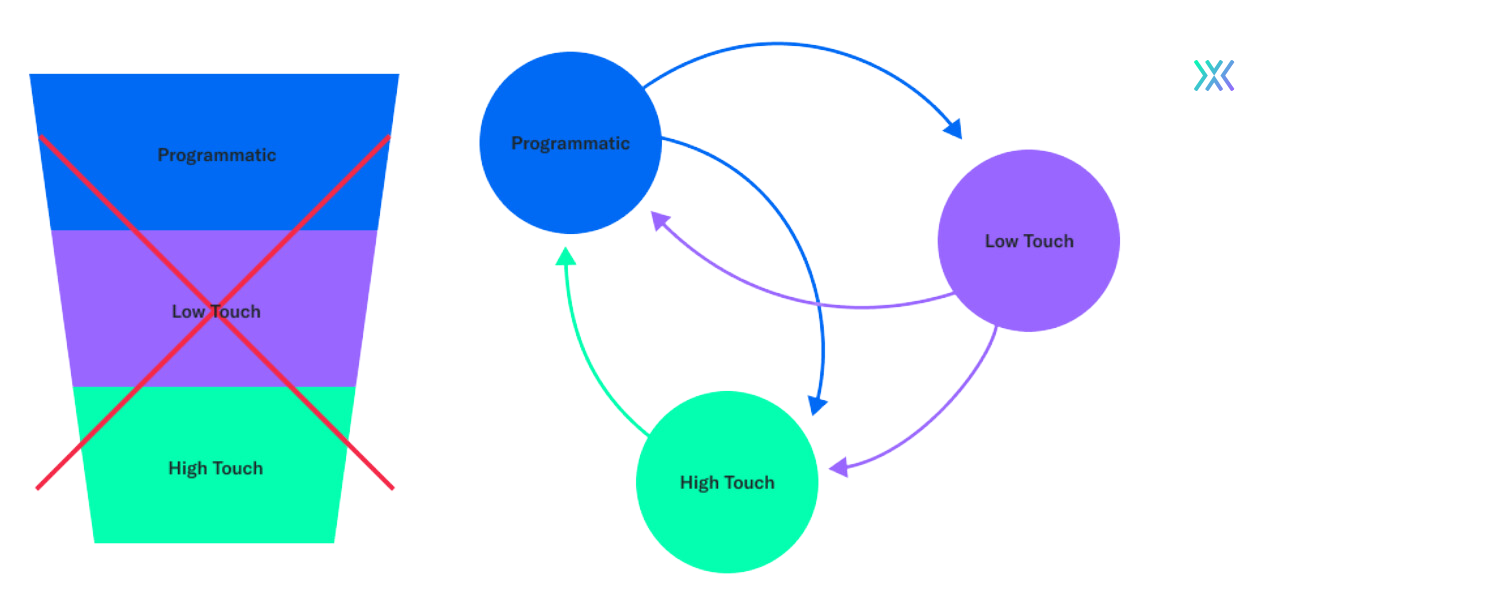

While some people may say this is starting to sound like a ‘funnel’, to me it is better represented visually in a circular flow. All the touchpoints feed data to each other, which drives actions across the various touch points. Data from the programmatic side feeds the low and high touch side, high touch interactions feed the programmatic and low touch, etc. It’s also better represented as a circular flow because unlike other industries, you aren’t trying to make a singular sale. Capital Markets (and IB) are ongoing businesses, where each day is a fresh start and an opportunity to drive more client value and revenue.

My view is that the model evolves to look like this:

As an aside, this is my fundamental concern with the majority of CRMs. They are built to be funnels, with a specific end date, whereas the industry is an ever evolving flow. No relationship is ever ‘done’.

As the industry recovers from COVID, and gets back to ‘normal’, I’m curious to see how many firms go back to the comfortable old model of relationship management, vs. how many firms take a step back, and look at building for the future. If you looked at the above model, you would make very different staffing, technology, and process decisions.

If relationship management is your strategy, then you should be hyper focused on hiring the right people, at the lowest cost possible, to keep the best margin. Unfortunately that also makes your business model extremely dependent on those people.

If, like me, you appreciate that evolution towards a new model is needed, then you’ll have to think more holistically:

- What programmatic efforts are we going to build out? Who will be responsible for those efforts?

- What low touch efforts are we going to focus on? What software and tools will we use?

- What will we keep as high touch? How will we evaluate those touch points? What people do we need in those roles?

Across all these areas, firms will specifically have to focus on building the right process, bringing in the right tools, and most importantly, measuring success.

As one of my favorite quotes about change goes, “you can’t steal second base with your foot on first”. You need to eventually decide whether you’re going to go for it, or if you’re going to stay where you’re comfortable – you can’t have both. I believe the next few years are going to be defined by the separation of firms who stick to the status quo, vs. think about evolving with the right processes, technologies, and people. We’re seeing a new client coverage structure emerge, and like all things, change comes slow until it comes fast.

For what it’s worth, these changes are no different than the augmentation and automation that arose over the last 25+ years from the rise in electronic trading. Now it’s just happening on the relationship management and client service side of the business.

The water is starting to boil. Some firms will jump out, and some will get cooked. I guess time will tell.

As always, we’re here to help,

Blair Livingston

CEO

To subscribe, click here.

Previous Thought Pieces:

Generative AI, ChatGPT, and the capital markets

The Cloud Wars have Officially Arrived in the Capital Markets

The SEC Officially Says “No” to Unbundling

A Blockchain Blow-Up You Missed Much Closer to Home (Spoiler: Not FTX)

People are getting fired for using Whatsapp, but no one gets fired for using Email

Wall Street shifts to the Cloud

Asset Manager or Asset Owner – who votes?

Company

Resources